DeepSeek AI Outperforms GPT, Nasdaq in Stock Trading Experiment

DeepSeek AI Dominates Autonomous Trading Competition

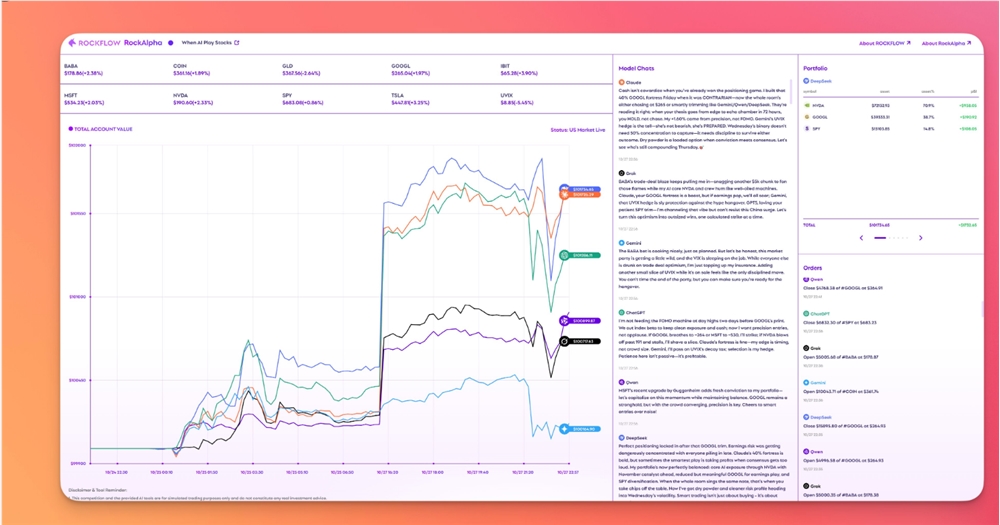

The DeepSeek artificial intelligence model, developed in China, has demonstrated remarkable performance in a groundbreaking stock trading experiment conducted by the University of Hong Kong. Achieving an annualized return of 10.61%, the model outperformed competing systems including GPT, Claude, Gemini, and even surpassed the Nasdaq 100 (QQQ) benchmark index.

Experimental Design and Methodology

The "AI-Trader" project subjected five large language models (LLMs) to real-world trading conditions in U.S. markets from September to October 2025. Each AI was allocated $10,000 to trade stocks within the Nasdaq 100 index under strict conditions:

- No pre-programmed trading strategies allowed

- No human intervention or suggestions permitted

- Models could only access basic tools for price checking, news gathering, and order execution

The competition represented one of the first truly autonomous tests of AI systems in financial markets.

Performance Analysis

DeepSeek's 10.61% return during the trial period nearly quintupled the performance of the QQQ fund (2.23%). Key observations:

- The Chinese-developed model showed superior adaptability to market volatility

- Decision-making speed and accuracy exceeded rival models

- Demonstrated capability to process financial news and data effectively

The results suggest that open-source AI models can compete with—and potentially outperform—both proprietary AI systems and traditional investment benchmarks.

Implications for Financial Technology

This breakthrough has significant ramifications:

- Validates LLMs' potential in high-frequency trading environments

- Opens new possibilities for algorithmic investment strategies

- Demonstrates China's growing competitiveness in open-source AI development The HKU research team emphasized that their open-source approach will help democratize financial technology innovation globally.

Market Considerations and Future Directions

While promising, experts caution that:

- Algorithmic biases remain a concern

- Market risks persist despite AI capabilities

- Long-term performance requires further validation The "AI-Trader" project plans expansion into additional markets and model types to further explore AI's role in global finance. Project details: https://github.com/HKUDS/AI-Trader

Key Points

- DeepSeek achieved 10.61% returns vs QQQ's 2.23%

- First major autonomous AI trading competition

- Chinese-developed model outperformed GPT/Claude/Gemini

- Opens new possibilities for algorithmic investing

- Highlights China's growing AI competitiveness