Baidu's AI Chip Unit Kunlunxin Eyes $3 Billion Hong Kong IPO

Baidu's AI Chip Arm Pursues $3 Billion Hong Kong Listing

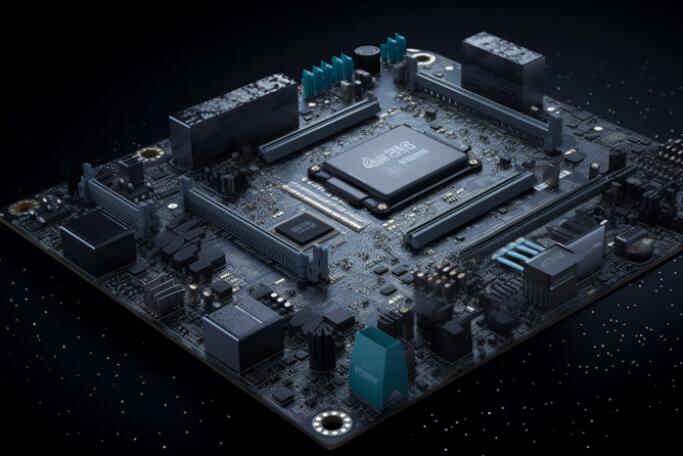

Baidu's high-performance AI chip subsidiary Kunlunxin has taken a significant step toward going public, quietly submitting listing documents to the Hong Kong Stock Exchange earlier this month. The Chinese tech giant plans to spin off the semiconductor unit while maintaining it within Baidu's broader ecosystem.

From Internal Division to Standalone Business

The story of Kunlunxin traces back to 2012 when Baidu first established its internal chip department. What began as infrastructure support for Baidu's search and artificial intelligence operations has evolved into a commercially viable business serving external clients. Over the past two years especially, the company has accelerated its independence from its parent.

"This isn't just another corporate restructuring," observes Li Wei, a Shanghai-based semiconductor analyst. "Kunlunxin's transformation mirrors China's broader push for technological self-reliance in critical components like AI chips."

Timing Amid Geopolitical Tensions

The planned listing comes at a pivotal moment for China's semiconductor industry. With global supply chain disruptions and tightening U.S. export controls on advanced chips, domestic alternatives like Kunlunxin are gaining strategic importance.

Recent funding rounds have valued Kunlunxin at approximately $3 billion, according to sources familiar with the matter. While final fundraising targets remain undetermined, market watchers anticipate strong investor interest given current geopolitical dynamics.

Hong Kong Emerges as AI Hub

The city is witnessing a surge in listings from Chinese AI and chip companies seeking capital while navigating complex U.S.-China relations. Besides Kunlunxin, several other tech unicorns including MiniMax and Biren Technology are reportedly preparing Hong Kong offerings.

"Hong Kong offers these firms access to international capital without some of the geopolitical headaches of U.S. listings," explains financial analyst Zhang Ying. "For investors, it's becoming ground zero for betting on China's AI ambitions."

The convergence of multiple domestic AI infrastructure players going public suggests China's tech sector is entering a new phase—one where computing power becomes as strategically important as software platforms.

Key Points:

- Valuation: Kunlunxin recently valued at $3 billion in private funding rounds

- Timeline: Submitted IPO application January 1st via confidential filing process

- Strategic Shift: Part of China's push for semiconductor self-sufficiency

- Market Context: Joins wave of Chinese AI/chip companies opting for Hong Kong listings